There are a lot of questions about why and how to get a business card. Since there are many benefits to getting a business card this post aims to debunk some of the questions regarding how to apply for one, why you should get one, and some of the top offers available.

Why get a business card?

Some of the best welcome bonuses are offered by business cards. With a handful of card offers you can double dip on bonuses by getting both the personal and business version of the card. Applying for business credit cards is an easy way to earn extra miles and points and opens the door to new welcome bonus offers.

Benefits of getting a business card:

More welcome bonus opportunities

An easy way to earn more miles and points

Keeping your business spending and expenses separate

The credit line, credit utilization, and account age do not show on your personal credit report

One of the biggest benefits of applying for a business credit card is that the credit line is not reflected in personal credit reports. This means that a the credit utilization and credit account age does not impact personal credit score in the long run. However, your personal credit score will be pulled when applying for a business credit card so you will have a hard credit inquiry from the application. The impact from this generally diminishes after 3-6 months, but will show on your personal credit score for 2 years. Note that most business credit cards generally do not have all the same consumer protection benefits that personal cards have and some are charge cards that you must pay off in full every month (you should always pay off all your cards in full every month).

Don’t think you have a business?

Obviously if you already have your own business, getting a business card is simple and easy.

Not sure if you have a business? You can have any type of business to qualify for a business card just as long as you have anything that remotely resembles a privately owned, profit driven organization that is designed to provide goods and services. That doesn't mean that your business has to currently be profitable, you can still be in the startup phase and have no revenue as of yet--and still qualify for a business card.

You may have your own business and not even know it. If you provide any services (designing, consulting, property management, etc) or sell goods (sell books on ebay, part-time photographer, jewelry, odd jobs for a friend or neighbor) you have a business. Remember, you don't have to have a large business, it doesn't even have to be registered, and it certainly doesn't have to be incorporated. But if you are making an income and are self employed, then you have a business!

Don’t have a business today, then why not start tomorrow? You can get a business credit card even if you are only in the planning stages of launching your business. You can be a startup venture and not have any revenue and still get approved for a business card, albeit your chances of approval may be a little lower because of the risk the credit card company sees in lending money to a startup.

Top 5 Business Card Offers

These are the top 5 business card offers in my opinion:

Some helpful tips on how to fill out a business card application

When you apply for a business card, the questions asked on the application are virtually the same from one application to another, so I will walk you through them. There are a few elements in a business card application that differ from a personal card.

Usually at the start of the application there are some boxes that you have to agree to that make you personally liable for the debts of the business and acknowledge that you have not had any bankruptcy in the past. If you are applying for a Chase business card you will also have to click a box that asks you to confirm that you have not been denied any credit cards by Chase within the last 6 months.

The next step of the application will ask about your business. Here are some tips for filling in this part:

Legal Name of Business: Use your name (or any business name) as the legal business name if your business is a sole proprietor.

Business Address: Use your home address if the business is based out of your home (this is most likely be the address that you normally use on credit card applications).

Type Of Business: Sole Proprietor.

Tax Identification Number: Use your social security number.

Years in Business Under Current Owner: If you just started (or thinking of) your business put 1 year, if longer enter the number of years in business.

Nature of Business: Input the best fitting option. If you are selling goods, put ‘retail’, if you are a consultant, put ‘other’.

Number of Employees: Since you are a sole proprietor, you are the only employee so enter 1.

Annual Business Revenue/Sales: Input the total sales/revenue your business brings in, if it just started you can enter 0.

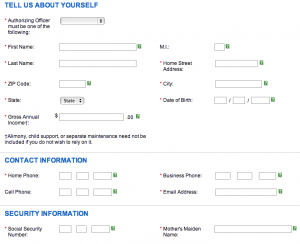

The application continues on with questions about yourself:

Authorizing Officer must be one of the following: Select “owner” if you are a sole proprietor.

Gross Annual Income: Input gross household income unless if asks specifically for individual income.

In the next section you will enter all your other personal information such as your name, address and date of birth.

The last and final step is to authorize the application process by clicking the box that you read and agree to the terms and conditions.

And hopefully you will get instantly approved!

The Bottom Line

Since you don’t need to have a big or well established business to get approved for business cards, they are a great way to earn extra miles and points. Many of the top signup offers are for business cards and you can always double dip and earn twice the points by getting both the personal and business version of the cards. The added benefits of the credit line and age not impacting your credit score make applying for a business card a no brainer in my opinion.

*If you found this post useful, why don’t sign-up to receive free blog posts via email (max of 1 email per day!) or like us on Facebook…and never miss an update!